Pvm Accounting - An Overview

Pvm Accounting - An Overview

Blog Article

3 Simple Techniques For Pvm Accounting

Table of ContentsThe 2-Minute Rule for Pvm AccountingFascination About Pvm AccountingPvm Accounting Can Be Fun For AnyoneHow Pvm Accounting can Save You Time, Stress, and Money.6 Simple Techniques For Pvm AccountingSome Ideas on Pvm Accounting You Need To KnowAn Unbiased View of Pvm Accounting

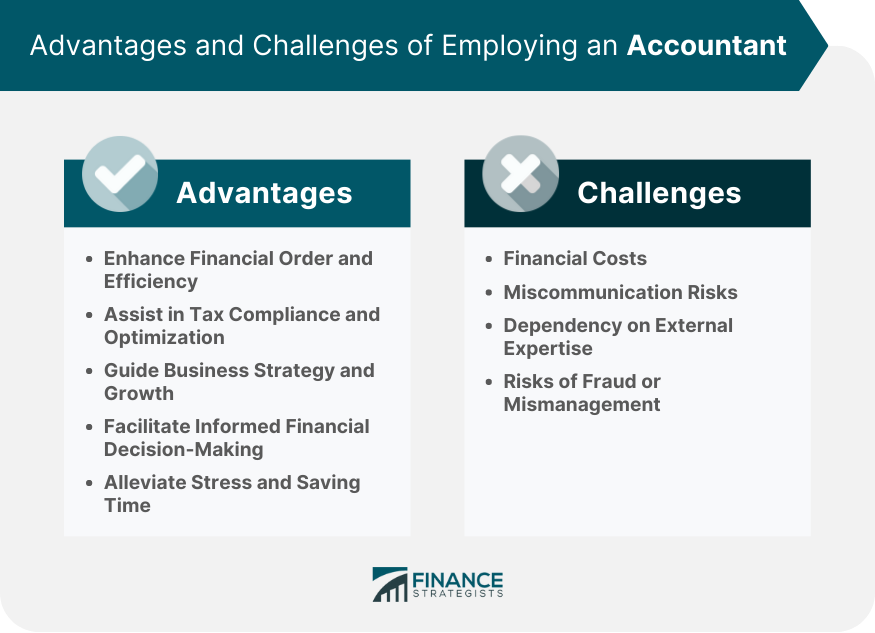

As soon as you have a handful of choices for a local business accounting professional, bring them in for brief meetings. https://rndirectors.com/author/pvmaccount1ng/. Local business owner have several various other responsibilities geared towards development and development and do not have the moment to handle their funds. If you possess a local business, you are most likely to manage public or private accountants, who can be employed for an in-house solution or contracted out from a book-keeping firmAs you can see, accountants can help you out during every phase of your firm's growth. That does not indicate you have to hire one, but the right accounting professional needs to make life less complicated for you, so you can focus on what you like doing. A certified public accountant can assist in tax obligations while likewise offering clients with non-tax services such as auditing and financial advising.

A Biased View of Pvm Accounting

Hiring an accountant decreases the chance of filing unreliable documentation, it does not totally remove the possibility of human error impacting the tax obligation return. An individual accountant can assist you prepare your retired life and additionally withdrawl.

An accounting professional is a specialist who supervises the economic health of your company, day in and day out. Every little organization owner ought to consider hiring an accountant before they in fact require one.

Little Known Facts About Pvm Accounting.

They'll likewise likely included a beneficial specialist network, as well as wisdom from the successes and failings of services like your own. Working With a Certified Public Accountant who comprehends https://turbo-tax.org/why-you-should-hire-an-accountant-for-your/ check my blog fixed possession accounting can correctly value your genuine estate while remaining on top of aspects that influence the numbers as time takes place.

Your accounting professional will certainly additionally give you a sense of necessary startup costs and financial investments and can reveal you just how to maintain operating also in durations of lowered or adverse money circulation. - https://pagespeed.web.dev/analysis/https-www-victoriamarcelleaccountant-com/7eyanprcv9?form_factor=mobile

The Ultimate Guide To Pvm Accounting

Declaring tax obligations and taking care of funds can be especially challenging for small business owners, as it calls for expertise of tax codes and economic regulations. A Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) can provide indispensable support to little service owners and help them navigate the complicated world of finance.

: When it comes to accounting, audit, and monetary planning, a CPA has the knowledge and experience to help you make educated choices. This know-how can conserve local business owners both time and cash, as they can count on the CPA's understanding to ensure they are making the most effective economic options for their business.

Pvm Accounting Can Be Fun For Anyone

Certified public accountants are trained to remain up-to-date with tax regulations and can prepare accurate and timely income tax return. This can save local business owners from frustrations down the line and ensure they do not deal with any kind of charges or fines.: A CPA can additionally help local business proprietors with financial planning, which entails budgeting and forecasting for future growth.

: A CPA can likewise supply beneficial insight and evaluation for local business proprietors. They can aid identify areas where business is prospering and locations that require renovation. Equipped with this details, small company proprietors can make adjustments to their operations to optimize their profits.: Finally, hiring a CPA can provide small company owners with comfort.

Indicators on Pvm Accounting You Should Know

The government will not have the funds to offer the services we all count upon without our taxes. For this factor, every person is encouraged to prepare their tax obligations before the due day to ensure they avoid fines.

The size of your income tax return depends upon many variables, including your earnings, reductions, and credit histories. Because of this, working with an accountant is advised since they can see everything to ensure you get the optimum amount of cash. Despite this, many individuals decline to do so because they believe it's absolutely nothing more than an unneeded expense.

Pvm Accounting Fundamentals Explained

When you work with an accounting professional, they can assist you avoid these blunders and guarantee you obtain one of the most money back from your tax return. They have the expertise and expertise to know what you're eligible for and how to get one of the most money back - Clean-up bookkeeping. Tax obligation period is typically a difficult time for any type of taxpayer, and for a great factor

Report this page